Nearshoring, Evolved: Why 2025 is the Real Test for LATAM-to-U.S. Supply Chain

By Source Logistics on Oct 16, 2025 12:53:31 PM

Nearshoring in Latin America is no longer a speculative narrative – it’s under real pressure, and the winners now will be those who move with conviction.

In 2025, U.S. tariff turbulence, border constraints, and peak-season demands are exposing the difference between optimism and operational viability. But that stress is exactly where the opportunity lies. For LATAM exporters and U.S. importers, the question is no longer if nearshoring should play a role, but how to deploy it in a way that turns volatility into competitive advantage.

This post will:

-

- Map the present-day conditions reshaping nearshoring (tariffs, capacity, trade talks).

- Highlight which nearshoring shifts are proving durable.

- Show where premature bets can backfire.

- Offer tactical, opportunity-first strategies you can act on now.

- Illustrate how a partner like Source can help you lean into this inflection.

1. The 2025 Backdrop: Why This Moment Matters

Tariff policy is redefining risk and timing:

-

- A recent Manufacturing Dive article notes that U.S., Mexico, and Canada trade officials are bracing for further tariff turbulence, even as the USMCA framework gives room for exemptions and negotiations.

- The U.S. extended a tariff moratorium on Mexican imports that comply with USMCA rules, delaying duties of up to 30%.

- Meanwhile, in the automotive and parts sectors, proposals for new “truck tariffs” are under discussion – potentially affecting cross-border parts and components trade.

- The U.S. also recently launched a consultation window for USMCA review, inviting stakeholder feedback on potential adjustment in trade rules.

Takeaway: The tariff and trade policy landscape remains highly dynamic. Strong nearshoring strategies must embed compliance agility and scenario readiness.

Capacity dynamics and logistics stress:

-

- Americas Market Intelligence flags a wave of container overcapacity and rate pressure globally, while many LATAM ports lack the depth or handling technology to absorb it.

- Mexico is doubling down on port modernization: the Port of Manzanillo is undergoing a major expansion to handle growing trade volume despite tariff headwinds.

- Analysts are projecting that Mexico’s freight and logistics market will expand significantly through 2030, fueled by nearshoring and infrastructure investment.

- Mexico is also launching a broad national port modernization push (estimated ~$22B in scope) to boost customs, multimodal access, and throughput capabilities.

Takeaway: The gap between capacity upgrades and demand is narrowing. The port-to-inland logistics chain – not just ocean shipping – is the true battleground.

Regional economic and political contours:

-

- The IMF now projects Latin America and the Caribbean to grow ~2.0% in 2025, down from 2.4%, as tighter U.S. policy and slowing demand bite.

- Mexico’s economy has cooled more sharply than expected. The Bank of Mexico cut its 2025 forecast from 1.4% to ~0.1%, later revising slightly upward to 0.6%, citing weak domestic activity and tariff uncertainty.

- Brazil offers a counterweight: GDP grew 1.4% Q1 over Q4 2024, with the central bank lifting its 2025 forecast to 2.1%.

- Despite mixed growth, governments continue to bet on logistics infrastructure as an economic stabilizer – Mexico is pushing ahead with intermodal corridor investments and expanded port capacity.

Takeaway: Economic momentum across LATAM is uneven – Mexico’s slowdown contrasts with resilience elsewhere – but nearly every major economy is doubling down on logistics infrastructure as a growth hedge.

2. What’s Actually Emerging as Durable – the Nearshoring Moves that are Actually Panning Out

USMCA alignment as a commercial moat:

USMCA compliance is proving to be the most dependable defense against tariff turbulence. Firms with verified origin documentation and certificate management are insulating themselves from policy shocks.

Multi-node regional diversification:

Forward-looking exporters are balancing exposure by establishing complementary hubs in Colombia, Costa Rica, and Brazil to mitigate geopolitical and infrastructure risk.

Infrastructure-driven corridors:

Port expansions and corridor projects are turning previous choke points into viable logistics arteries, shortening inland lead times and reducing demurrage.

Agile hybrid execution:

Leading manufacturers are adopting modular approaches – combining partial assembly in Mexico, finishing in the U.S., and flex warehousing to absorb policy or demand swings.

3. Where Hype Still Outpaces Reality – Caution Flags-

- Premature capital deployment before validated volume creates stranded assets.

- Regulatory and power constraints remain under-estimated execution risks.

- Over-reliance on Mexico leaves networks exposed to policy volatility.

- Waiting for perfect clarity can cost first-mover capacity advantages.

4. Tactical Moves for Q4 2025 and Beyond

-

- Model full landed costs – include tariffs, drayage, customs variance, and alternate routes.

- Harden USMCA compliance – ensure materials origin certification and outing resilience.

- Reserve buffer capacity early – warehousing, cross-docks, bonded zones.

- Phase modular deployments – start small, scale as performance validates.

- Enhance visibility – control towers and exception alerts for early rerouting.

- Partner deeply – align with providers fluent in compliance, policy, and cross-border execution.

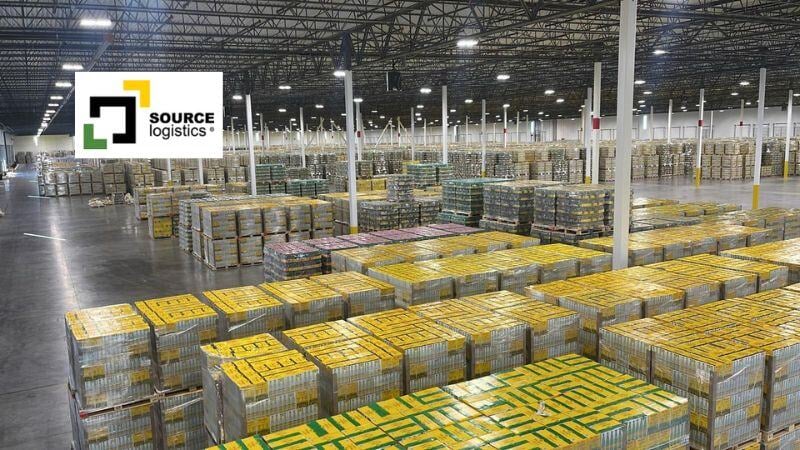

5. Why Source Logistics Tilts the Edge

-

- Integrated port-to-door execution keeps LATAM goods moving through uncertainty.

- Customs and tariff expertise to operationalize USMCA and safeguard margins.

- Forward-capacity design securing inland DCs and bonded facilities ahead of demand.

- Scenario-planning muscle for tariff cliffs, surges, or reroutes.

- Local insight across Mexico and Central America for early issue detection.

Source doesn’t just move freight – it stabilizes networks.

Seize the Advantage: Build a Nearshoring Strategy That Wins Through Uncertainty

As Manufacturing Dive reported this week, USMCA partners are “bracing for tariff turbulence – but see openings to strengthen North American manufacturing.”

That headline captures 2025 perfectly. Tariffs and politics may shift overnight, but they’re also accelerating regional integration. The shippers who act now to secure compliance, capacity, and control will define the next wave of nearshoring success.

Source Logistics helps you convert volatility into velocity. Nearshoring isn’t stalling – it’s evolving. The question is: who will be ready when the rules shift? We’re ready to help you.

Schedule your Nearshoring Readiness Diagnostic today to model tariff exposure, map diversification options, and secure the U.S. footprint that will carry you through the next market cycle.

You May Also Like

These Related Stories

The Explosive Growth of Hispanic Food and Beverage in the U.S.

Navigating Freight Logistics in the U.S. with the Right 3PL Partner